Resource Center

Have questions about Christian Community Credit Union? Looking for financial resources and tools? Our Resource Center is our information hub for blogs, videos, newsletters, and more!

Featured Resources

Read 10 Ways to Spring Clean Your Credit

Ah, springtime. Longer days, warmer temperatures. It’s the time of year when your thoughts may run toward cleaning out the garage. It’s also a wonderful time to tidy up your...

Read Should Christians Build Credit? Unveiling 5 Crucial Tips for Financial Wisdom!

Your financial reputation boils down to a three-digit number known as your credit score. Your score is somewhere between 300 and 850 (the higher, the better) and it plays an...

Read Should a Christian Ever Be In Debt?

The Bible never says that going into debt is a sin. However, it issues a very stark warning: “The rich rule over the poor, and the borrower is slave to...

Blog

Read 3 Church Leadership Conversations on Giving

Church leaders talk about financial matters all the time, and it is not uncommon for these conversations to be focused primarily on the progress toward your giving goals. For an...

Read 10 Ways to Spring Clean Your Credit

Ah, springtime. Longer days, warmer temperatures. It’s the time of year when your thoughts may run toward cleaning out the garage. It’s also a wonderful time to tidy up your...

Read 5 Smart Ways to Utilize Your Tax Refund

If you have you filed your tax return for 2023 and are due for a refund, now’s the time to decide what to do with the money. When money comes...

Videos

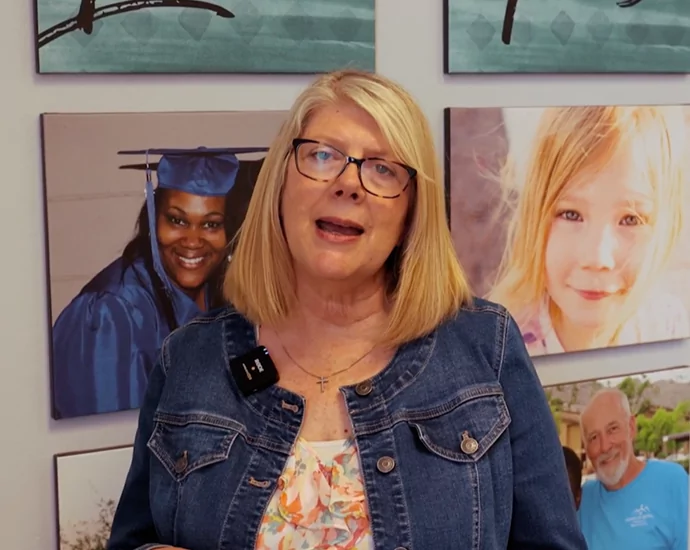

Read House of Refuge Sunnyslope – Member Testimonial

House of Refuge Sunnyslope (HRS) in Arizona, is a ministry who equips individuals to break free from homelessness. HRS CEO Julie Supplee shares her appreciation on how CCCU’s partnership allowed...

Read At CCCU Service is our Promise

Faith & finances. God & money. Ever wonder how they go together as you seek to serve God and support yourself and your loved ones? Check out this video about...

Read Renewed Purpose, New Look

Much has changed since the Credit Union was founded 65 years ago. We first began as American Baptist Ministers Credit Union in 1957. Thirteen years later, the Credit Union became...