You might prefer to use electronic payment options, but paper checks are still important. According to the Federal Reserve’s 2013 study, 18.3 billion checks are written every year. Another study by market research firm New Heights Research showed that over half of all landlords only accept paper checks.

Since they’re less common these days, it can be confusing to know how to write out a paper check properly. We’ve put this quick guide together to help.

Your Check, Explained:

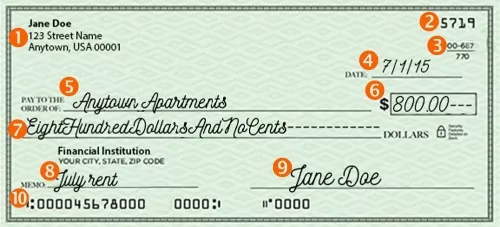

1. Name: Your name and address are always printed here. Your bank’s name and address are always printed under the written amount line (below number 7 in the illustration above).

2. Check Number: The number of the check (important to know for tracking your checks and balancing bank statements).

3. Fraction Code: A code that identifies your bank and the place it should send checks for processing. You’ll rarely use this number for anything.

4. Date: Here’s where you fill in the date you are writing the check.

5. Payee Name: The name of the person or company who gets the money goes here.

6. Number Amount: Write the amount of money the check is for here, in numbers. Use a line to fill in any unused part of the box.

7. Written Amount: Write the amount of money the check is for here, in words. Use a line to fill in any unused space.

Make sure your numbers are written closely together to prevent fraud. Make sure you write “hundred” or “thousand” rather than “hundreds” or “thousands,” as the extra letter “s” may cause your check to be rejected. Your written amount must match the number amount in item number 6 above.

8. Memo line: This part is optional, but you should write down the purpose of this check in case there are any questions later.

9. Signature: Be sure to sign your check with your name exactly as it’s printed on your check. Never sign your check before all of the other fields are filled in. This will help prevent fraud.

10. Routing number & account number: The first group of numbers is a “routing number,” which is a code specific to your bank. The second group of numbers is your account number. There may be a third group of numbers, which represents the number of your check (as in item number 2 above).

You may be asked to provide your checking account number and your bank’s routing number when making online payments using your checking account (sometimes called an “e-check”).

Never give out your account number unless you’re on a secure website (look for “https:” instead of “http:,” as well as a lock symbol, in the web address). Also, never give out your account number if you are on a public WiFi network that isn’t secure.

Knowing how to write a paper check is still a very useful skill, particularly when paying rent or dealing with merchants who don’t accept credit or debit cards.

Explore the “checking” part of your checking account with these simple rules. Then, you’ll always be ready to fill out a check whenever the occasion requires it.

This article should not be considered legal, tax, or financial advice. You may wish to consult a tax or financial advisor about your individual financial situation.

This article was updated 12/12/16 to edit images.