“The master was full of praise. ‘Well done, my good and faithful servant. You have been faithful in handling this small amount, so now I will give you many more responsibilities. Let’s celebrate together!’” Matthew 25:21 (NLT)

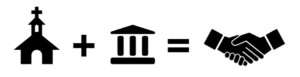

Churches and banks often relate to each other as consumer and provider. In this kind of relationship, the bank and church have opposite goals. The bank wants to collect as much as possible on loans and pay back as little as possible on deposits. Meanwhile, the church wants to get the lowest possible interest rates on loans and the highest possible dividends on deposits.

There’s nothing wrong with this kind of relationship. But it doesn’t have the creative energy that a real partnership can bring. Here are three ways your ministry can get the most out of your banking relationship.

- Offering Financial Advice

A bank can be much more than just a service provider. It can be a valued partner and advisor as well. All of our ministry development officers have years of experience working with churches and ministries. This helps them to offer ministries useful financial help and advice.

For example, some churches have a cash flow shortage during the summer. Their development officer acts as a liaison. He or she represents the church’s situation to the bank’s management.

Recently, one of our partners, a mid-sized church, decided to reinvent itself. The church was going to transition from a traditional service to a home church-based model. In doing this, the church faced one big problem. That problem was their 50,000-square foot church building. The congregation didn’t need it any more, but there was still a loan on the property.

The Credit Union has many contacts with commercial real estate brokers and leasing agents. Together, the Credit Union and the church worked out a lease and purchase strategy. The church paid off the loan and bought a smaller building debt-free. The Credit Union offered a loan to the buyer of the building. Thanks to a strong partnership, this situation ended in a win for both sides.

- Controlling Construction Costs

For both lenders and ministries, construction loans present a risk. With construction loans, the ministry and the lender have the same goal. They both want the project completed on schedule and within budget. Lenders usually build conditions into the loan agreement to help make this happen.

Ministries may oppose these conditions because they can mean more cash is required up front. But usually, the contractor is the one to object. When ministries partner with the Credit Union, they can work together on how to resolve this. Usually, this results in a more efficient and less risky project.

- Working Together to Grow Your Ministry

Partnering with lenders can help both bank and ministry grow. In one case, a large missionary organization needed to expand its income. The Credit Union was seeking organizations to partner with for charitable donations. A partnership began and the Credit Union issued a credit card with the missionary organization’s logo.

When members used the credit card for purchases, the Credit Union donated some of its interchange income (fees that merchants pay to card issuers) to the organization. The card provides the organization with ongoing donations. Also, the card encouraged Credit Union members to learn more about the organization. This helped the organization grow its donor base.

It’s a good idea to examine your ministry’s business relationships regularly. This includes the relationship with your bank or lender. Keep these questions in mind:

- Do they understand the issues that you face? Do they have expertise that will help you navigate those issues?

- Do they understand your vision for your ministry’s future?

- Can you use their network to help add value to your ministry?

- Do you have any shared goals?

- Are there opportunities to work and grow together?

Forming a strong partnership with your bank can help you both succeed. Most importantly, it can help you expand your ministry in a healthy, sustainable way. Contact The Ministry Development Group today!